Minnesota is a no-fault state for car accidents. Minnesotans use their insurance coverage first for medical bills and lost wages after an accident, regardless of who was at fault. No-fault insurance won’t cover all of your damages. When your losses exceed your insurance policy limits, you may need to seek compensation for your damages through the at-fault party’s insurance and, if necessary, by filing a lawsuit.

If another driver caused your car accident, get the compensation you deserve by reaching out to our distinguished Minnesota car accident lawyers. If you’re ready to take the next step, contact us for a free consultation where we’ll discuss your claim and compensation options.

What Does Minnesota's No-Fault Insurance Cover?

No-fault insurance, also called first-party benefits or personal injury protection, compensates car accident victims by having them submit a claim against their own insurance policy instead of a third party.

The minimum PIP coverage in Minnesota is $40,000. Of that, $20,000 applies to medical expenses, and $20,000 pays for lost wages, funeral expenses, and other income replacement needs. You can use your PIP insurance if you’re a driver in a crash, a passenger not covered by someone else’s policy, or if you’re hit by a vehicle while walking or biking.

If your expenses exceed your PIP policy limits, you can seek compensation through the at-fault driver’s liability insurance. Minnesota’s minimum liability car insurance requirements are $30,000 for injury to one person, $60,000 for two or more people, and $10,000 for property damage.

If the other party’s insurance company offers less compensation than you deserve, and your damages exceed the coverage limits of both insurance policies, you may need to file a lawsuit to recover the full compensation you need.

Our skilled attorneys will review your insurance policy, explain your benefits, and advise you of your options to recover compensation for your injury and losses.

What Isn't Covered by No-Fault Insurance?

No-fault insurance won’t pay for property damage or non-economic losses like pain and suffering. If another driver caused the crash, you’ll need to seek compensation through their liability insurance to recover those damages.

Because no-fault coverage has limits, many drivers choose to add additional protections to their policy. To protect yourself further, consider optional coverage like collision, comprehensive, and uninsured/underinsured motorist insurance. These help cover vehicle repairs and accidents with drivers who lack sufficient coverage.

What Does It Mean That Minnesota Is a No-Fault State?

In a no-fault state, if you’re in an accident, your own insurance will cover your medical bills and lost wages, no matter who caused the crash. In a fault-based state, the driver who caused the accident is responsible for covering the damages. You would need to prove they were at fault before you recover damages.

Every state has its own rules, and how no-fault laws affect your case can vary. Consult our skilled car accident lawyers if you have questions about your Minnesota PIP coverage and any other insurance laws that apply to your case. Our legal team can explain how these laws work and explain your legal options.

Who Pays for Damages Not Covered by No-Fault Insurance?

If your damages exceed or fall outside your PIP coverage, you can pursue compensation against the at-fault driver through their liability coverage, but you must show that the other driver was at fault. You may also face pushback from their insurance company, which might try to minimize your payout or deny your claim. Our team can help you navigate this process and fight for the compensation you deserve.

In some accidents, you may have to turn to your mandatory uninsured (UM) or underinsured (UIM) coverage. UM insurance protects you when the other driver is uninsured or if you are involved in a hit-and-run. UIM coverage offers additional protection for incidents when the at-fault driver’s liability coverage isn’t enough to pay for all your damages.

Even if both drivers have insurance, policy limits may cap the damages you can recover via an insurance claim. When that happens, a lawsuit against the other driver or person responsible for your crash may be the only way to recoup your total losses.

Our award-winning attorneys can determine who is responsible for your crash and who is liable for damages insurance doesn’t cover. We are committed to providing top-tier legal representation.

And we’ll assist you in taking action to pursue compensation.

Can You Sue Outside of Minnesota's No-Fault System?

If you have an injury requiring long-term care or rehabilitation, you may end up with medical costs or lost wages that exceed PIP coverage. To recover the full extent of your damages, you may need to look to the other driver’s liability coverage or file a personal injury lawsuit for financial relief.

A lawsuit may be appropriate to recover non-economic damages, such as pain and suffering or emotional distress. However, under Minnesota law, you must meet one of the following eligibility requirements:

- Your medical expenses exceed $4,000

- You have a permanent injury or disfigurement

- Your loved one died

- Your accident led to a disability exceeding 60 days

Don’t risk missing out on compensation by navigating the legal process alone. Our knowledgeable car accident attorneys have significant experience with insurance claims and know how to handle filing your lawsuit outside the no-fault system.

Our attorneys can determine whether your case qualifies for legal action beyond the no-fault insurance system and guide you through every step of the process, from investigating the crash to negotiating with insurers or taking your case to court. If you decide to sue, we will notify the other party and file the necessary paperwork with the court on your behalf.

Who Pays for Damages Not Covered by No-Fault Insurance

If your accident-related costs go beyond what no-fault (PIP) insurance covers, you may be able to recover the remaining damages through the at-fault driver’s liability insurance. This includes compensation for medical bills, lost wages, property damage, and pain and suffering not covered under your policy.

In some cases, additional coverage—like uninsured/underinsured motorist protection—may also apply if the at-fault driver doesn’t have enough insurance to fully cover your losses.

Recovering full compensation isn’t always easy. Insurance companies may dispute fault, undervalue your claim, or delay payments. That’s why partnering with a trusted attorney is important to level the playing field against powerful insurance companies.

Our attorneys can help identify who is legally responsible for your damages, gather the evidence needed to prove fault, and take action to hold the right parties accountable. Whether that means negotiating with insurers or filing a lawsuit, we’ll fight to make sure you’re not left paying out of pocket for someone else’s negligence.

Common Misconceptions About Minnesota's No-Fault Law

Many people assume that Minnesota’s no-fault insurance system means fault doesn’t matter or that you can’t file a lawsuit after a car accident. That’s not true.

While no-fault coverage is designed to compensate a crash victim regardless of who caused the crash, it doesn’t mean the at-fault driver is off the hook—or that you’re stuck with limited compensation.

When your damages go beyond your PIP coverage, you may have the right to pursue a claim against the at-fault driver’s insurance or file a lawsuit to recover the full cost of your injuries and other losses.

At Brown & Crouppen Law Firm, we help clients understand their rights under Minnesota’s no-fault laws. You don’t have to navigate this alone. We’ll walk you through your options, explain what the law allows, and fight to get you every dollar you deserve.

How Can a Lawyer Help Navigate Minnesota's No-Fault Laws?

While filing a no-fault PIP claim may seem straightforward, problems, including delayed or denied compensation, are not uncommon.

To start, you must request a claim form and file your PIP claim within six months of your accident. In addition to the application, you must provide proof detailing your expenses, and your insurance company may request a medical examination.

Even though PIP is meant to provide quick access to benefits, insurance companies still look for ways to minimize what they pay. They might argue that your injuries aren’t severe, question how long you were off work, or claim you missed a deadline.

Avoid the frustration of taking on insurers alone—work with our seasoned team of attorneys and allow us to handle the process on your behalf. We’ll guide you through the claims process by:

- Preparing and submitting your initial PIP claim with all required documentation

- Handling disputes with your insurance company or the other driver’s insurer

- Identifying additional sources of compensation when your injuries exceed policy limits

- Ensuring all paperwork is filed accurately and on time

Brown & Crouppen Can Help With Your No-Fault Insurance Claim

Minnesota is a no-fault state, but that doesn’t mean getting full compensation after a car accident is easy. Insurance companies often fight claims or offer unfair settlements, so you may have to take legal action to get fair compensation.

Partner with our experienced legal team to avoid pitfalls in the insurance process and level the playing field against insurers. Our top-rated attorneys have significant experience dealing with insurance companies and determining when to file legal claims outside the no-fault system.

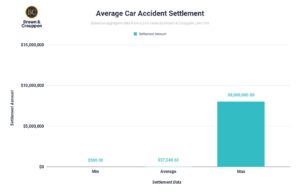

We’ve assisted thousands of clients and recovered over $1 billion in compensation. Let us put our winning approach to work for you. Reach out by calling 800-536-4357 or completing our contact form for a free case evaluation.