Step 1: Ensure Safety

After a collision, if you are able, move to a safe location. Under no circumstances should you leave the accident scene, regardless of its severity, without filing a report. Doing so could leave you legally vulnerable to claims against you and allow the other parties to provide their version of events. Be sure to contact 911 so that a proper investigation and report can be made. The police may also call EMS to attend to any potential injuries. If the police do not respond to the scene, visit a police station and file a report as soon as possible.

Limit your interactions with other drivers and only provide statements to the police officers and EMS. If possible, take photographs of the crash scene and any damage to your vehicle.

Use our legal checklist to learn what to do after an accident and understand key legal considerations for recovering financial compensation.

Step 2: Evaluate for Injuries

Your physical health should be the number one priority after the collision. If you refuse EMS treatment, driving yourself to urgent care or the emergency room is still important to get checked out. Adrenaline can often mask severe injuries.

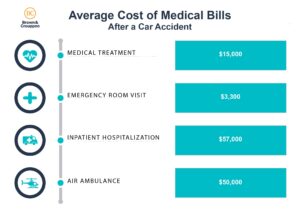

Car accidents can result in a wide variety of injuries, including broken bones, whiplash, and head trauma. Seeking prompt medical attention ensures your health is addressed correctly. Ongoing medical care and attention to your recovery not only support your physical well-being but also strengthen the credibility of your legal claim by documenting the extent and seriousness of your injuries.

Keeping detailed records of medical evaluations, treatments, and expenses is also vital for your recovery and any potential legal or insurance claims. Photographing your injuries and any visible damage can strengthen your claim to recover compensation after a car accident.

Step 3: Exchange Contact

Ensure you obtain the other driver(s) ‘s information including their name, contact information, license plates, and insurance information. Keep this interaction with them brief, and do not discuss the fault of the collision with them; allow police officers to investigate that thoroughly. Avoid any apologies directed to other drivers that can be interpreted as admitting fault. Stay calm during the interaction and trust that any discrepancies about what happened will be addressed appropriately later.

If possible, take photos of any damage to the other vehicle and the license plate.

Step 4: Obtain all Documents

You can request a copy of the police report after completing the investigation. If necessary, insurance companies will likely use this document to value the claim and in future court proceedings. The police report will document critical details of the collision, including statements from all parties involved, the officer’s observations, and the names of those involved if contact information wasn’t exchanged at the scene.

Additional relevant documents may include medical records, photos of the scene, and any notes you made about the incident, such as your feelings, weather conditions, and immediate recollections of the events. This information can be valuable if court proceedings become necessary, as it can help refresh your memory and support your case.

Step 5: Contact an Attorney

Step 6: Contact Insurance Company

Once you have prioritized your health and recovery, the next step is to inform your insurance company about the accident. Share any relevant information you’ve gathered, such as the police report and photos from the scene. Be cautious with your statements—avoid admitting fault or providing a detailed account of the incident on record without first consulting an attorney, as these statements could be used against you later.

How an Attorney Can Help with a Car Accident

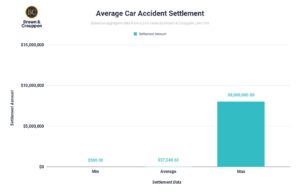

Each case is unique, and the amount you may receive from your claim will vary depending on the severity of the car accident, accompanying injuries, and other case factors detailed below. Our personal injury attorneys have helped thousands of individuals recover compensation for injuries, including individuals who are injured from a car accident. If you or a loved one is suffering from an injury or has symptoms following a car accident, you may be eligible to recover compensation. Getting started with your case is easy.

Call (800) 536-4357 or request a free case evaluation online. And remember, there are no upfront costs or legal fees – we only get paid if you win

Common Mistakes by Injured Parties after a Car Crash

Failing to follow these steps or making common mistakes does not automatically invalidate your claim, but it can impact the amount of compensation you may receive. Every case is unique and should be reviewed by an experienced attorney who can advocate for you and work to build a strong case on your behalf.

- Delaying Medical Attention – Failing to seek immediate medical care can worsen your injuries and make it harder to prove they were caused by the accident. Skipping follow-up appointments can also hinder your recovery and weaken your claim.

- Admitting Fault – Avoid apologizing or admitting fault, even out of politeness, as such statements can be used against you in insurance claims or legal proceedings.

- Making Statements to the Other Party’s Insurer – Refrain from providing statements, mainly recorded ones, to the other driver’s insurance company without consulting legal advice, as this could harm your case.

- Not Calling the Police or Leaving the Scene – Filing a police report provides an official accident record. Leaving the scene can lead to legal repercussions or accusations against you.

- Ignoring Minor Symptoms – Adrenaline can mask your injuries, and minor aches and pains can later lead to more severe injuries.

Additional Legal Considerations

1. Statute of Limitations: Each state has a specific time limit for filing a personal injury or property damage lawsuit.

- Personal Injury: Typically ranges from 1-3 years from the date of the accident.

- Property Damage: May have a different statute of limitations.

Failing to file within the specified timeframe may forfeit your right to compensation.

2. What to Do if Injured: If you’re injured in an auto accident, it’s important to follow the steps outlined below.

- Keep all medical records, bills, and receipts.

- Follow your doctor’s treatment plan to document the extent and impact of your injuries.

- Consider filing a personal injury claim to recover damages for medical expenses, lost wages, and pain and suffering.

3. Handling Disputes Over Fault: If there’s disagreement about who caused the accident, evidence such as police reports, witness statements, and traffic camera footage can help clarify the situation. Your attorney can also assist in building a strong case.

4. Dealing with Uninsured or Underinsured Drivers: If the other driver lacks sufficient insurance, you may need to rely on your uninsured/underinsured motorist coverage, if available.

5. Preserving Evidence: Keep all accident-related documents, including police reports, medical records, repair estimates, and correspondence with insurance companies. This documentation is crucial if the case proceeds to court.

6. Avoiding Legal Pitfalls: Do not accept an early settlement offer without consulting an attorney, as it may undervalue your claim. It’s also important to refrain from posting about the accident on social media, as such posts can be used against you in legal proceedings.

Get Help from A Personal Injury Attorney at Brown and Crouppen

If you or a loved one is suffering due to a car accident, you might be entitled to compensation. The choice of a lawyer is an important one and should not be decided without careful consideration.

Our legal team is here to help you learn more about your legal options and evaluate the strength of your accident claim. We care about our community and have dedicated our practice to helping injury victims recover justice, accountability, and compensation

Get started today with your free case evaluation by visiting Brown & Crouppen online or by calling us at (800) 536-4357. Our St. Louis and Kansas City personal injury lawyers have helped clients recover over $1 billion in settlements and verdicts. And remember, there are no upfront costs or legal fees – we only get paid if you win.