Types of Uber Lawsuits

Injured Passenger Lawsuits

As discussed below, passengers are protected by a $1 million liability policy. Typically, claims are directed towards Uber rather than the individual driver. In many instances, the resolution of the claim resembles standard insurance procedures, minimizing the necessity for personal injury litigation. However, while a personal injury lawsuit may not always be required, it remains crucial to secure legal representation to advocate for your entitlement to comprehensive and fair compensation during insurance claim discussions with Uber.

Collisions Caused by Uber Driver

The decision to pursue legal action against an Uber driver hinges on their operational status at the time of the incident. If the driver was off-duty or without a passenger, the claim would likely be directed towards the driver rather than the company. This is due to Uber typically denying claims if the driver was not actively engaged in transporting a passenger (or “on the clock”) at the time of the accident. Conversely, if the driver was actively transporting a passenger, Uber’s $1 million policy would typically apply to cover any resulting injuries or damages.

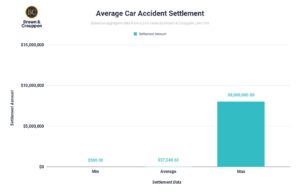

Successful Uber Lawsuits

Uber accidents are a common occurrence, given the vast number of drivers – approximately 1.5 million – operating in the United States, often resulting in passenger injuries. While the company’s liability insurance policy covers up to $1 million, settlements frequently fall below this threshold. Nonetheless, the insurance company requires compelling evidence demonstrating the Uber driver’s liability and the case’s value. It is crucial to enlist the expertise of a lawyer who can adeptly navigate these complexities on your behalf.

Young Child Fatally Injured While Crossing Street

In 2013, a young child tragically lost her life after being struck by an Uber driver while crossing a street. The driver was using the app but didn’t have a passenger at the time. In 2016, the family reached a settlement, the details of which remain undisclosed.

Passengers Sustain Serious Injuries in Collision

In 2015, a doctor and wife sustained injuries in a collision resulting from a failure-to-yield incident caused by an Uber driver in Miami. The couple were passengers in the Uber at

the time of the accident. Subsequently, they filed a lawsuit against Uber and eventually reached a settlement agreement, the details of which were not disclosed.

Passenger Injured by Uber Driver

In 2021, a 34-year-old male was getting into an Uber vehicle when the Uber driver started pulling off before he had fully entered the backseat, catching his right leg under the rear tire. Plaintiff suffered a right hip labral tear and femoral impingement which required injections and surgery. A jury awarded Plaintiff $674,000.00.

Proving Fault: Uber’s Liability In Rideshare Accident

Uber’s liability for personal injuries is a topic governed not only by law but also by the company’s insurance policy. Central to this discussion is Uber’s classification of drivers as independent contractors, a distinction that underscores the nuances of liability in the ridesharing realm.

In essence, Uber drivers operate as independent entities, utilizing Uber’s technology platform to facilitate rides and generate income. Consequently, when drivers are not actively engaged in providing rides through the Uber platform, the company’s liability is limited. Note that the mere presence of an Uber sticker on a vehicle does not automatically imply ownership or employment by Uber. Instead, it signifies the driver’s affiliation with the platform.

However, Uber’s liability extends beyond mere contractual arrangements. While drivers are logged into the app but without a passenger on board, the company maintains a limited liability policy, covering up to $50,000 for personal injury and property damage. Once a passenger is in the vehicle, Uber’s liability becomes more defined. The company maintains a comprehensive third-party insurance policy, covering up to $1 million for accidents during the ride. However, accessing the full extent of this coverage often necessitates adept legal argumentation and evidence, provided by an experienced Uber accident attorney.

Were you injured in an accident due to someone else’s negligence? Get legal help from the most effective injury law firm in the Midwest.

Understanding Uber’s Insurance Policies

The level of insurance coverage accessible to you depends on several factors, including whether you were a passenger during the accident or if the Uber driver was on duty at the time. These factors also dictate which party you may need to pursue legal action against – either Uber itself or the individual driver.

- Uber Driver is “Off-the-Clock”: The driver’s auto insurance extends coverage during periods when they are not actively engaged in providing Uber services. The driver must maintain personal automobile insurance at the mandatory minimum limits prescribed by state law. Specifically, in Missouri, these limits are set at $25,000 per person for bodily injury and $50,000 per accident for bodily injury.

- Uber Driver is Available but Between Rides: Uber’s third-party liability insurance serves as a safeguard if the Uber driver is responsible for an accident, ensuring coverage for bodily injury and vehicle damage sustained by another party. Specifically, this insurance policy guarantees a minimum of $50,000 per person for bodily injury and $100,000 per accident for bodily injury, thus providing financial protection to those affected by such incidents.

- Uber Driver is Carrying a Passenger: The insurance policy governing Uber drivers’ vehicles is structured to provide coverage for passenger autos utilized within specific operational contexts. This coverage extends to instances when drivers are actively logged into the Uber network and available to receive ride requests, as well as during the transition from accepting a request to reaching the pick-up location, and throughout the entire journey, including drop-offs at passenger’s final destinations.

Uber’s insurance policy clearly defines its liability, which may leave injured parties ineligible for coverage if their situation falls outside policy guidelines. This can complicate recovery, especially as many insurance providers prohibit passenger vehicles for commercial use. Depending on the driver’s personal insurance policy, injured individuals may struggle to obtain compensation from either Uber or the driver. If Uber’s policy guidelines are not met and the driver’s personal insurance policy declares the accident excluded from coverage, it is important to seek guidance and legal advice from an experienced rideshare attorney.

How to Prove Fault after an Uber Accident

Navigating an Uber accident’s aftermath can be complex, especially when determining the driver’s status at the time. Legal actions often involve both the driver and Uber. Seeking clarification from Uber regarding the driver’s status is pivotal and can be facilitated by legal counsel. Such a nuanced assessment underscores the intricate nature of determining responsibility, necessitating expert legal consultation to determine the full extent of liability for each party, and prove fault to recover full compensation.

The choice of a lawyer is an important one and should not be decided without careful consideration. If you or a loved one has been injured, the experienced attorneys at Brown & Crouppen can help you seek financial compensation. Navigating the complexities of rideshare liability is an area in which our attorneys have great experience and confidence.

Getting started with your case is easy. Call (888) 802-8156 or get a free case evaluation online. And remember, there are no upfront costs or legal fees – we only get paid if you win. Our St. Louis and Kansas City personal injury lawyers have helped clients recover over $1 billion in settlements and verdicts.