Be Cautious of What You Tell a GEICO Claims Adjuster

When you are in a car accident, you should exchange insurance information with the other drivers involved. Claims are filed with the insurance companies, and the claims adjusters, who conduct investigations and negotiate settlements, contact those involved.

The GEICO claims adjuster will attempt to elicit information and statements from you that might help reduce their claims payouts. Everything you say to an insurance adjuster can be used in their investigation and affect their settlement offer. Be especially careful when discussing the following:

- Injuries: When talking with claims adjusters, the natural tendency to downplay injuries to avoid complaining can be costly. Even answering a polite initial “how are you?” with the typical answer of “fine” could impact your claim. GEICO claims adjusters are trained to be personable and seem helpful, manipulating you into making statements that negatively impact your settlement.

- The accident: When asked to describe the accident, stick to the facts and avoid voicing any assumptions or opinions.

- Your expenses: If you share information about expenses too early, you may not receive compensation for later costs. For example, if follow-up medical test results indicate a need for additional, costly medical services, those expenses may not be included in the settlement offer if you already shared your expenses with the claims adjuster.

If you’ve been injured in a car accident, you are already in enough pain. Do not let GEICO insurance adjusters also use your words against you. An experienced Brown & Crouppen attorney will navigate the conversations with GEICO claims adjusters and handle all communications for you.

Don’t Agree To Be Recorded

At the beginning of a call with a GEICO adjuster, you may hear a recorded message indicating that the call will be recorded, possibly for quality control purposes, or the adjuster may request your permission to record your call.

Do not agree to be recorded. Anything recorded can be used to deny your claim or reduce the compensation you receive.

The adjuster may insist that you are legally required to provide a recorded statement. You are not. No state laws require you to provide a recorded statement to another party’s insurance company unless a lawsuit has been filed, at which point your attorney will guide you through the process.

Should I Wait to Get a Car Accident Lawyer?

Don’t wait too long before consulting with a car accident lawyer, especially if you believe you have a legitimate claim for compensation. There are several reasons for this:

- Statute of limitations: Every state has a statute of limitations, which is a legal time limit within which you must file a lawsuit after an accident. If you wait too long, you may lose your right to pursue legal action. Consulting with a lawyer early on can help ensure that you are aware of and adhere to these time limits.

- Preservation of evidence: Evidence is crucial in personal injury cases. The sooner you involve a lawyer, the better they can help gather and preserve evidence such as witness statements, accident reports, medical records, and other documentation that may be critical to your case.

- Communication with insurance companies: Insurance companies may try to settle quickly, sometimes offering lower amounts than you may be entitled to. Having a lawyer early on can help protect your interests and ensure that any communication with insurance companies is managed properly.

- Legal guidance from the beginning: A lawyer can provide valuable guidance from the outset, advising you on what steps to take and what information to gather. This can help strengthen your case and avoid potential pitfalls.

- Negotiations and settlement discussions: If you are seeking a settlement, having a lawyer early in the process can help with negotiations. They can assess the true value of your claim, handle discussions with insurance companies, and work towards securing a fair settlement on your behalf.

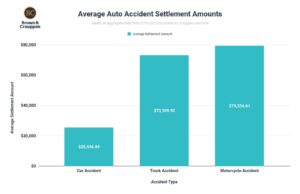

Note: The typical car accident settlement amount is over $37,000. However, each case is unique and highly dependent on case factors, which means your case may be higher or lower than the average settlement.

Don’t Accept a Lowball Offer

GEICO promises a speedy, uncomplicated claims process. While speed and ease may sound appealing—especially when managing the inconveniences associated with damaged vehicles and injuries—the drawbacks greatly outweigh the benefits. Swift resolution can greatly reduce your compensation. An attorney will help reduce your stress and fight for fair compensation.

The first settlement offer from GEICO will most likely not fairly cover your damages. It may be calculated before the extent of your damages, including potentially unexpected medical expenses and loss of income, is clear. For example, an initial offer may cover six physical therapy appointments. After those six appointments, your physical therapist could determine that you need six additional appointments. If you already accepted the original offer, you cannot return to GEICO and ask them to cover the additional therapy.

During negotiations with a GEICO auto claims adjuster, an experienced car accident attorney will discuss all your costs, including the potential for future medical expenses and loss of income. Negotiations may require a back-and-forth between the insurer’s claims adjuster and your attorney, and various settlements may be offered and rejected. If a fair settlement cannot be reached, the case could go to trial.

To protect your rights, consult an experienced car accident attorney before accepting any settlement offers.

How Will an Attorney Help Me With the GEICO Adjuster?

Insurance companies work hard to limit claim payouts. An experienced St. Louis car accident attorney can take on powerful insurance companies like GEICO. Here’s what your attorney will do:

- Adjuster contact. Your attorney can manage all communications with GEICO claims adjusters, eliminating worries about saying the wrong thing and allowing you to focus on your recovery instead of phone calls with claims adjusters.

- Evidence collection. This includes gathering medical records, physical evidence, police reports, maintenance records, photos, and videos.

- Investigation. Your attorney will conduct an independent investigation, analyze the accident, and determine fault.

- Refute allegations of shared fault. If the opposition attempts to blame you for the accident, your lawyer can fight back and protect your right to full compensation.

- Obtain expert opinions. Your attorney may consult medical professionals and other experts to bolster your case.

- Settlement offer review and negotiations. Your attorney will review settlement offers and handle negotiations to fight for fair compensation.

- Agreement review. Your attorney will review documents releasing GEICO and the insured from further legal action.

- Trial. Your attorney will represent you at trial if a fair settlement offer cannot be reached.

Lawyers Will Fight for Full Compensation

When the insurer makes a settlement offer, an experienced car accident attorney will evaluate whether it fairly covers your damages. If it does not, they will make a counteroffer. This process will continue until a fair settlement is reached. If no agreement can be reached, your attorney will take your case to trial. Whether at the negotiation table or in the courtroom, your attorney will take on powerful insurance companies to fight for full compensation.

We’ve won settlements that are up to 30 times higher than the original settlement offers. With more than 250 legal professionals having over 1,000 combined years of experience handling complex car accident cases, Brown & Crouppen knows how to combat GEICO’s tactics. We have recovered over $1 billion for our clients, including multiple cases with million-dollar awards.

Injury Claims vs Property Claims

Injury Claims

Injury claims, also called bodily injury claims or personal injury claims, seek compensation for losses and expenses associated with a physical injury, such as:

- Current and future medical expenses

- Loss of income and predicted future loss of income

- Pain and suffering

- Mental and emotional anguish

- Additional expenses incurred from the accident

Property Claims

Property claims, also called property damage claims, can be handled by your attorney. These claims let you seek compensation for property damaged in the accident and related expenses, such as:

- The cost to repair your vehicle at the repair shop of your choice

- The cost to replace your vehicle if it’s totaled

- Rental car costs incurred as you wait for vehicle repairs or a replacement vehicle

You are not obligated to use GEICO’s car repair program, although they will likely encourage you to do so.

Contact Brown & Crouppen for a Free Consultation

Brown & Crouppen was founded with one goal: getting justice for people who have been injured. Get the representation you deserve. Contact us or call us at 800-536-4357 for your free personal injury case evaluation.