Types of Lost Wages That Can Be Reimbursed

Lost wages refer to money, income, and benefits that you are unable to earn after a car accident. Examples of lost wages include:

- Regular Earnings – Compensation for your regular hourly wages or salary you would have earned if you did not have to miss work due to your injuries.

- Miscellaneous/Unique Earnings – Outside of your regularly-scheduled routine compensation, you may be entitled to compensation for other earnings. Examples include:

- Benefits – Items you regularly received from your employer as a benefit could potentially be considered lost wages. Examples include employer allowances for insurance, transportation, cell phones, profit-sharing plans, stock options, etc.

- Bonuses/Commission – You may be entitled to compensation for commissions and bonuses if you were going to earn that commission or bonus had you worked your regular schedule.

- Overtime – You may be entitled to compensation for overtime if overtime opportunities were regularly available to you prior to the accident and would have been available to you had you worked. Occasional/seasonal overtime pay might be available as well if your job usually offers overtime during the same periods each year. Example: department store workers who receive overtime opportunities around busy holidays.

- Paid Time Off (PTO) – If you used paid time off (sick days, vacation days, and other earned days) to rest, recover, or to attend doctors’ appointments for your accident-related injuries, you may be able to receive reimbursement for those days.

- Raises/Promotions – If you were on track to receive a raise or promotion (for example: your annual review was coming up) but that opportunity was missed or delayed due to being out of work for accident-related injuries, you may be able to receive compensation.

- Retirement Fund Contributions – If you or your employer regularly contributed to a retirement/pension plan but contributions had to be withheld due to financial difficulties related to missing work, you may be entitled to compensation for those missed contributions and/or your employer’s matching contributions.

Use our legal checklist to learn what to do after an accident and understand key legal considerations for recovering financial compensation.

If you can prove that you would have earned compensation through work if you hadn’t been injured in a car accident, you can receive compensation for it. Injured passengers in accidents may also be eligible to recover lost wages.

It’s important to understand how lost wages might affect the value of your claim with the help of an attorney. This is because once you have settled with the insurance company, you will generally not be able to pursue any future claims for damages (such as lost wages) that may not have been considered.

How Long Does It Take To Get Lost Wages From A Car Accident?

For car accident cases with clear liability, compensation for lost wages is generally received within 6-9 months. However, the time it takes to receive compensation for lost wages after a car accident can vary depending on several factors:

- Insurance Claim Process: The speed of the insurance claim process can greatly affect how quickly you receive payment for lost wages. Once you submit all necessary documentation, including proof of your lost income and the accident report, the insurance company will review your claim. This process can take anywhere from a few weeks to a couple of months.

- Dispute and Negotiation: If there is a dispute about the claim, such as the cause of the accident or the amount of lost wages, this can delay the process. Negotiations between your lawyer (if you have one) and the insurance company can extend the timeline.

- Legal Proceedings: If your claim cannot be settled through direct negotiations with the insurance company, it may proceed to litigation. Going to court can significantly extend the time it takes to receive your car accident compensation, potentially taking several months to years.

- State Laws and Regulations: Different states have various laws and procedures that can influence the duration of the claims process. For example, some states have specific timelines that insurance companies must adhere to when responding to a claim.

- Efficiency of Documentation: The promptness with which you are able to gather and submit all necessary documentation (medical records, proof of income, etc.) can also affect the speed of the process.

Proving Lost Income After A Car Accident

Insurance adjusters deal with a large number of personal injury claims and therefore want to avoid overcompensating fraudulent or meritless claims. In order for you to receive compensation for lost wages, it makes sense that you have to prove your wages were actually lost. It is not enough to speculate, guess, or claim that you “might” have lost wages. The following documents are extremely persuasive in supporting a claim for lost wages:

- Paychecks showing the wages/income you were regularly receiving in the months leading up to the accident. Demonstrating a pattern is even more persuasive that you were guaranteed to receive a certain amount. For example: 3 months of pay statements/pay stubs just prior to the accident showing that you were regularly receiving the same amount each month and always worked a set number of hours.

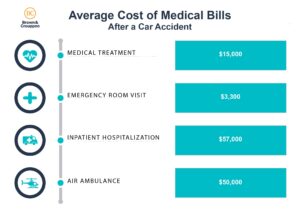

- Doctors’ notes that detail your medical treatment plan and evidence why it was necessary for you to miss work. The average cost of hospital bills after an accident can be high, so it’s important that there’s supporting evidence and documentation. Missing work due to physician recommendations is always more persuasive than simply choosing to miss work for an extended period of time. For example, your primary care physician might prescribe physical therapy 2 times a week for 6 weeks in order for you to return to your pre-accident status. Their treatment recommendation might also state the importance of complying with a physical therapy program and how missing appointments can hinder recovery, thus demonstrating why missing work for appointments is necessary. Your physician stating that the nature of your job duties will hinder your recovery, especially in manual labor jobs, is also persuasive. Examples include weight lifting restrictions, shift restrictions such as no standing for more than 4 hours at a time, no operating heavy machinery while on medication, etc.

- Correspondence from your employer verifying the number of days/hours you missed from work and the opportunities you missed. Some examples include letters from previous periods leading up to the accident that show you were always eligible for a bonus/raise every quarter, letters evidencing your excellent job performance, prior commissions, etc. Additionally, if your job duties or job title changes and you are only eligible for a lower paying job due to the nature of your injuries (example: your job prior to the accident required you to lift heavy objects, but after the accident your physician ordered you to refrain from lifting heavy objects), correspondence from your employer confirming this is extremely important. Be mindful that insurance adjusters will consider what actions you took to lessen your damages such as your willingness to accept other jobs or accept job duties that you could perform with your injuries. For example, maybe you were not able to work the full 40 hours you were able to before the accident, but evidence that you made an effort to work part-time (if approved by your physician) reflects positively on your claim for lost wages.

- Expert opinions on future earning capacity in the case of permanent, life-altering injuries. It is difficult to place a number on the amount of money you would have been capable of earning in the future. Individuals who suffer debilitating injuries can recover compensation for future loss of income and decreases in earning potential. Your attorney may consider hiring an economist or financial expert who specializes in calculating future loss of income. Such financial experts will consider numerous factors like your age, skills, training, credentials, job titles you held before the accident, and job titles you are limited to after the accident due to your injuries. This will help them form an opinion and even come up with an estimate of what you could have earned in the future had you not been injured.

Were you injured in an accident due to someone else’s negligence? Get legal help from the most effective injury law firm in the Midwest.

Although more challenging, you may still be able to recover compensation after an accident if your are uninsured if the other driver is at fault. This may include financial compensation for medical expenses, lost wages, and property damage to your vehicle.

Additional Legal Considerations for Lost Wage Reimbursement

When you hire a personal injury attorney at Brown & Crouppen, they will explain to you what documents in your possession are important to evidence your claim for lost wages. Your attorney can also assist you in obtaining such documentation if needed. The personal injury attorneys at Brown & Crouppen work persistently to obtain the highest value for your claim, so do not be surprised if they ask you questions regarding the nature of your employment in order to ascertain whether or not something can be included as lost wages. In some cases, your attorney might even point out something that could be considered lost wages that you did not think of.

In all cases, it is always beneficial to keep any documentation that evidences any loss of income, lost opportunity, or time from work whenever you are pursuing a personal injury claim. Damages cannot be recovered unless they are proven. Additionally, it’s important that you file a claim before the car accident statute of limitations deadline in your state.

Will Car Insurance Cover Lost Wages?

In Missouri, insurance is the first and primary source of compensation after a car accident. All drivers in the state are legally required to purchase a policy that satisfies Missouri state law, which include:

- Bodily injury liability: $25,000 per person, $50,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured motorist coverage: $25,000 per person, $50,000 per accident

Since Missouri is a fault-based state, you can seek benefits from the at-fault party’s car insurance company. This includes damages for lost wages under the policy’s bodily injury liability coverage.

If your lost wages and other damages exceed what the at-fault party’s insurance policy will pay, you reserve the right to file a lawsuit for additional damages.

What if I am Hit by an Uninsured Driver?

If you are involved in an accident with an uninsured driver in St.Louis, you can recover lost wages through your uninsured motorist (UM) coverage, which you are required to carry under state law. A study done by the Insurance Research Council showed that 16.4 percent of drivers in Missouri were uninsured in 2019.

Your employment contract (and related documentation) that detail important aspects of your job, including your rate of pay, paid time off, when you might be entitled to bonuses, benefits, and more. This information can lay a foundation for your lost wages claim.

How are Lost Wages Calculated?

Depending on how you are paid and the type of income you receive, calculating lost wages in a car accident claim in Kansas City can be complicated.

If you earn an hourly wage, you should receive your gross pay for every hour you have missed at work. If you earn a salary, you should receive your gross annual pay divided by the amount of time you have lost at work. If you miss two months on the job, you should receive compensation equal to two months of your gross pay.

If you use paid time off to recover, you are entitled to reimbursement for that time away from work, as well. After all, it is part of your compensation at work. PTO is calculated the same way your other lost wages are. One hour of PTO equals one hour of pay, one day of PTO equals one day of pay, and so forth.

Lost wage claims can become more complicated when you experience a loss of income for the foreseeable future or miss out on non-guaranteed income like bonuses or commissions. In these situations, expert testimony will likely be required to confirm that your losses are reasonably foreseeable.

Lost Wages for Self-Employment

You are also entitled to damages if you are self-employed, such as a freelancer or independent contractor. However, proving lost income can become a bit more complicated. You will have to rely on invoices, contracts, bank records, and tax returns to prove your reasonably certain future losses.

An experienced Missouri personal injury attorney can ensure your wages are properly calculated and that you are fully compensated for what you will miss out on while you recover.

Should You Accept a Settlement for Lost Wages?

A settlement might wrap up your car accident case and put money in your hands sooner rather than later. However, when you settle, you also waive your rights to seek additional compensation in the future. Typical settlements for lost wages generally take a couple months up to over 1 year to finalize, depending on the complexity of the case.

If you underestimate the seriousness of your injuries or the amount of missed work, you will be out of luck when your settlement check runs out.

You have limited options when it comes to your insurance coverage. Your insurer will only cover a portion of your damages up to your policy limits. However, you have more room to negotiate when you file a third-party claim or lawsuit. It is in your best interest to have a respected Missouri personal injury attorney as your advocate to ensure you are making the right decision for the short and long term.

Contact a Personal Injury Lawyer to Recover Lost Wages After a Car Accident

A car accident can disrupt your ability to work and provide for yourself and your family. Whether you are temporarily unable to work, miss out on opportunities for bonuses and commissions, or are sidelined completely, Brown & Crouppen is prepared to recover maximum financial compensation.

Contact our car accident attorneys to discuss your case and learn how we can help you get the lost wage damages you deserve. We offer a free, no-obligation case evaluation. Reach out to one of our Missouri law offices to schedule your meeting today. We have locations in St. Louis, Kansas City, O’Fallon, St. Charles, Washington, and Arnold.