Use our legal checklist to learn what to do after an accident and understand key legal considerations for recovering financial compensation.

Whether you can sue someone after settling with their insurance depends on the specific terms and conditions of the settlement agreement you reached with the insurance company. In general, settling with an insurance company typically involves signing a release of liability, which may prevent you from pursuing further legal action against the at-fault party.

Here are some key points to consider:

- Release of Liability: When you settle with an insurance company, you usually sign a release form that releases the at-fault party from any further liability related to the incident. This release typically prevents you from suing the at-fault party for additional damages related to the same incident.

- Scope of Settlement: The settlement agreement will outline what damages are covered by the settlement. If the settlement covers all your damages and losses related to the incident, you may not have grounds to sue for additional compensation.

- Legal Advice: It’s crucial to consult with a legal professional, such as a personal injury attorney, before signing any settlement agreement. They can review the terms and advise you on whether signing the release of liability would prevent you from pursuing further legal action.

Exceptions For Pursuing Legal Action After Settling

In some cases, there may be exceptions or nuances that allow you to pursue legal action even after settling with the insurance company.

- Example #1: If the at-fault party breached the terms of the settlement agreement or if new evidence comes to light (about the terms of the contract or whether any party lied or defrauded either party, not about the extent of your injury), you may have options to reopen the case.

- Example #2: If the at fault party’s insurance company offers their policy limits and the insured signs an affidavit declaring that they have no other insurance applicable to the incident, but later more insurance is discovered, you may be able to reopen the case.

Ultimately, the specifics of your situation and the terms of the settlement agreement will determine whether you can sue the at-fault party after settling with their insurance. It’s crucial to seek legal guidance to understand your rights and options fully.

What To Do Before Settling A Case

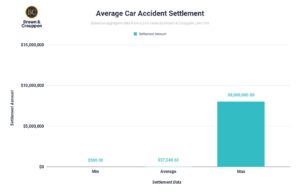

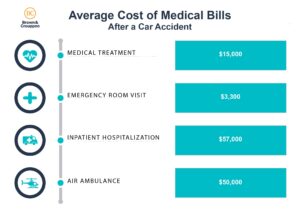

Before you decide to settle your injury claim, you need to be sure that the insurance company is taking into consideration all of your medical bills, lost wages (if applicable), and the injury to your actual person (pain and suffering).

You should consider consulting with an attorney before settling your injury claim. Below are some of the reasons why injured parties benefit from hiring a lawyer to handle their car wreck claim.

1. Find the relevant parties (and insurance coverages)

It’s easy to figure out who a defendant is when you are rear-ended: it’s the person driving the vehicle. However, depending on the state where the collision occurred and the circumstances, there may be more defendants, even in this scenario, such as the owner of the car, the employer of the driver (if the driver was working at the time of the crash), or even a restaurant that over served the defendant driver (depending on the state). Because most states only require that drivers carry liability coverage up to $25,000 per person, $50,000 per incident, that the insurance carrier may only be responsible for up to $25,000 to any one person injured in a collision, regardless of the severity of the injury. Finding additional defendants (and therefore additional insurance policies) can help cover the full extent of your damages.

2. Negotiate the settlement

One of the most important aspects of a personal injury attorney’s job is negotiating the claim. Because experienced attorneys have negotiated hundreds, if not thousands, of cases, they have a better idea of what the settlement value of the case should be given the facts and evidence before them. In negotiating a case, attorneys take a lot of different information into consideration.

Negotiations can happen at any point in the case and your attorney should always keep you informed on what evidence/information helps and hurts your case and the status of negotiations.

3. Determine relevant medical bills and liens to negotiate them down

Medical bills are not always clear cut. Depending on what state your injury occurred, a jury may be presented with different information about the cost of your medical treatment. In some states, the medical bills that can be submitted to the jury are the total bills before any insurance payments or contractual adjustments; in other states the jury can see the bills after the contractual adjustments and can consider the reasonable cost of treatment being only that which was actually paid or owed on the medical bill. This allows the at fault party, or more likely their insurer, to reap the benefit of the injured party carrying health insurance or the medical provider allowing charitable reductions in their billing without conferring any benefit to the injured party or to the public at large.

Get Help With Your Case From The Accident & Injury Attorneys at Brown & Crouppen Law Firm

If you or a loved one has suffered injuries from a car crash, you may be eligible to receive financial compensation for lost wages, medical expenses, pain and suffering, and other damages.

Getting started is easy. Get help from our legal team by calling us at 888-795-0694 for a free consultation, or get in touch with a car crash attorney by requesting a free case evaluation online. And remember, there’s no upfront cost to you — if you don’t get paid, we don’t get paid.