What To Do After an Accident If You Have Allstate Insurance

Your actions immediately after an accident can significantly affect the compensation you receive from Allstate. To protect your rights and potential payout, be sure to:

- Call 911 and report the accident to the authorities.

- Gather evidence at the scene, such as photos of the damage and any injuries and witness contact information.

- Seek medical attention even if you don’t feel injured.

- Follow all prescribed treatment plans.

- Consult with our award-winning personal injury lawyers before contacting Allstate.

- Do not accept a settlement offer from Allstate without having it reviewed by a skilled lawyer.

Allstate’s insurance adjusters may contact you soon after the accident to gather information or offer an early settlement. Remember, they are not on your side and will likely offer less than your claim is worth.

How To File a Car Accident Claim With Allstate Insurance

Filing a claim with Allstate can differ based on whether Allstate is your insurer or the insurer of the at-fault driver. If Allstate is your insurer, you can file a claim through their mobile app, website, or by calling their customer service. You’ll need your policy number, details of the incident, and any relevant documentation.

To preserve your coverage as an Allstate policyholder, you must report accidents before the deadline listed in your policy. However, even though they are your insurer, you cannot count on Allstate to put your interests before theirs. It is still wise to have an attorney review your claim to make sure you are compensated fairly.

If Allstate is the at-fault party’s insurer in your case, it is even more important to consult with an attorney first. In this case, you have no legal obligation to speak to their adjusters at all. Instead, let your personal injury lawyer do all of the talking. They will protect your legal rights and interests.

Were you injured in an accident due to someone else’s negligence? Get legal help from the most effective injury law firm in the Midwest.

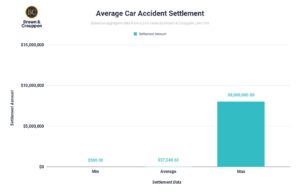

How To Determine the Value of Your Allstate Accident Claim

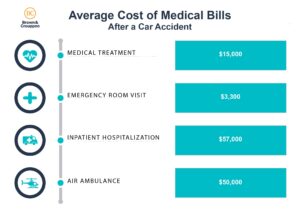

Working with an experienced personal injury attorney is the best way to determine your Allstate claim’s value. They will consider various factors to come up with a fair and accurate valuation, including the:

- Cost of your past and future medical expenses

- Impact your injuries have on your ability to work

- Extent of the pain and suffering you have experienced

- Cost of property damage, including car repairs, resulting from the accident

- Coverage limits of the involved parties’ insurance policies

Depending on your state’s laws, the degree of fault of each party involved in the accident may also affect the amount you receive. In Missouri, for example, if you are found partially at fault for the accident, your compensation may be reduced based on the percentage of fault assigned to you.

How To Negotiate a Settlement With Allstate Claims Adjuster

An insurance dispute lawyer is the most qualified person to handle negotiations with Allstate’s claims adjusters. It is best to avoid negotiating a settlement on your own, as the adjuster’s goal will be to settle for the lowest amount possible.

Dealing with Allstate after an accident without an attorney’s assistance may result in a settlement that does not fully cover your injuries and losses. You could also unintentionally do or say something that could harm your claim’s value. An attorney’s help will greatly improve your chances of receiving adequate compensation for your full damages.

If they find out you were in an accident, Allstate adjusters may reach out to you directly. Here are some ways you can protect yourself when dealing with insurance companies:

- Be wary of recorded statements. An Allstate adjuster may ask you to record a statement about the accident, but they will use the information you provide against you. Do not agree.

- Keep records of all documents related to the accident, including medical bills, repair estimates, and employment records. These documents will substantiate your claim for compensation from the insurance company. Your attorney can also use them to negotiate a higher settlement amount.

- Do not be afraid to reject low settlement offers. You have the right to decline any Allstate car accident settlements that do not adequately cover your losses and expenses. An attorney can help you determine the fair value of your claim and negotiate for a higher settlement.

- Be patient. Again, do not rush into a settlement agreement. It is crucial first to fully understand the extent of your injuries, damages, and their long-term effects on your life.

How Long Does It Take To Settle Claims With Allstate?

The time it takes to settle a claim with Allstate can vary depending on the specific circumstances of your case. Some claims may be resolved within a few weeks, while others may take months or over a year if the claim is highly disputed.

Though it can take longer to settle a case if you don’t accept a low settlement offer and instead take your case to court, it may be worth the wait if you are more likely to be compensated fully and fairly. Our attorneys can evaluate your case, determine the fair value of your damages, and help you decide the best course of action.

Get started with a free consultation with one of our skilled Personal Injury Lawyers today.

Need Help Dealing With Allstate Insurance Adjusters?

You have enough on your plate after suffering a personal injury. Let us help you handle the insurance adjusters. If you have trouble negotiating with Allstate, feel overwhelmed by the claims process, or need help dealing with Allstate’s nonpayment of claims, our experienced personal injury attorney can help.

Brown & Crouppen has represented countless injured people in communities throughout Missouri in Allstate accident claims. We have the skills and expertise needed to secure high-value case results. Contact us today at 800-536-4357 to schedule a free consultation and see how we can assist you in your Allstate claim.