Use our legal checklist to learn what to do after an accident and understand key legal considerations for recovering financial compensation.

1. Health Insurance Coverage

Generally, health insurance policies cover medical expenses resulting from accidents, including those from car accidents. This coverage may include hospitalization, surgery, medications, rehabilitation, and other necessary medical bills after a car accident.

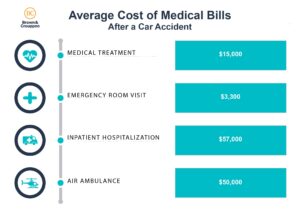

Note: The average inpatient hospitalization following an auto accident is $57,000. Given the generally high cost of medical treatment, it’s recommended to look to your health insurance policy for coverage of related medical bills – regardless of who may be at fault for the collision

2. Subrogation

If a health insurance carrier pays a medical bill that’s relevant to an auto accident that could be covered by another insurance carrier (i.e., an auto liability insurance carrier), then the health insurance carrier often has a right to subrogate (or to put in the place of another with regard to a legal right or claim) the amount they actually paid and get paid back out of the settlement.

This means that if you settle your claim and don’t pay it back out of the settlement, you may be hit with a lawsuit from your insurance carrier. Or, they may deny paying future claims until you pay them back.

3. Types of Health Insurance

- Employer-Sponsored Health Insurance: If you have health insurance through your employer, it may provide coverage for car accident injuries. The extent of coverage and any limitations will be outlined in your policy documents. However, self-funded employer-sponsored health insurance (that is intended to be subject to federal law, i.e., ERISA) generally has a right to be paid back when they pay out on the medical bills.

- Individual Health Insurance: If you’ve purchased health insurance on your own (e.g., through the Health Insurance Marketplace), your policy should also cover medical expenses related to car accident injuries, subject to the terms and conditions of your plan. Depending on your state’s laws, medical bills paid out of marketplace insurance may or may not need to be repaid after settlement.

- Medicare and Medicaid: These government programs may also cover car accident injuries, but the coverage specifics can vary. Federal and state laws require that money paid out of Medicare and Medicaid plans must be repaid. However, they will often take reductions.

5. Coverage Limits and Deductibles

Your health insurance policy may have coverage limits such as annual maximums or limits on certain types of treatments. Additionally, you may have to pay deductibles, copayments, or coinsurance amounts depending on your policy.

6. Coordination of Benefits

If you have multiple insurance policies (e.g., health insurance and auto insurance with medical payments coverage), there may be coordination of benefits rules that determine which policy pays first and how much is covered.

7. Auto Insurance Medical Payments (or Personal Injury Protection) Coverage

In some cases, auto insurance policies include medical-payments coverage (MedPay) or Personal Injury Protection coverage (PIP). This can help cover medical expenses for you and your passengers regardless of who is at fault in the accident. However, MedPay and PIP are optional in many states, so not all auto insurance policies will have these coverages.

8. Additional Legal Considerations

If you are injured in a car accident caused by another party’s negligence, you may also have the option to pursue a personal injury claim against the insurance company of the at-fault driver. This can help cover additional expenses not fully covered by health insurance, such as lost wages, pain and suffering, and other damages.

It may be necessary to review your health insurance policy documents, understand your coverage limits and any exclusions, and consult with your insurance provider or a legal professional if you have questions about coverage for car accident injuries. However, most personal injury attorneys are well-versed in understanding the interplay between health insurance and auto collisions.

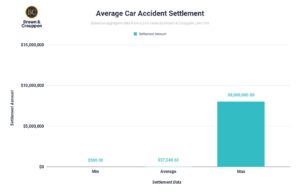

If you or a loved one has suffered injuries from a car crash, you may be eligible to receive financial compensation for lost wages, medical expenses, pain and suffering, and other damages. Getting started is easy. Get help from our legal team by calling us at 888-795-0694 for a free consultation. And remember, there’s no upfront cost to you — if you don’t get paid, we don’t get paid.