If you’re involved in a car accident where the other driver is at fault but you don’t have car insurance, you can still seek compensation for your economic damages like medical bills, lost wages, and property damage. However, you’ll face legal penalties for driving without insurance, and you may be limited in the types of damages you can recover. Additionally, navigating claims without an insurance company of your own can make the process more challenging.

Understanding the Consequences

1. Out-of-Pocket Expenses

- Claim Denials: The at-fault driver’s insurance might deny your claim or parts of it. Without your own insurer to advocate for you, appealing these decisions is more difficult.

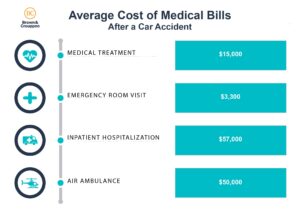

- Personal Costs: You may have to pay for medical treatments, vehicle repairs, and other expenses upfront, leaving you financially strained.

- Lack of Representation: Without insurance, you might not have access to legal resources that can help you navigate disputes with the at-fault driver’s insurance company.

2. Reduced Compensation

- Limitations on Damages: Some states restrict what uninsured drivers can recover. For example, under Missouri Revised Statute 303.390, uninsured motorists cannot claim non-economic damages like pain and suffering.

- Economic Damages Still Recoverable: You can still pursue compensation for tangible losses such as medical bills, lost wages, and property damage.

3. Legal Challenges

- Filing a Lawsuit: If insurance doesn’t cover all your expenses, suing the at-fault driver might be your only option to seek full compensation.

- Difficulty Collecting Compensation: If the at-fault driver lacks sufficient insurance or assets, collecting the full amount awarded in a lawsuit can be challenging if not impossible.

Penalties for Driving Without Insurance

Driving without insurance is illegal and can result in severe penalties, even if you’re not at fault in an accident. Penalties vary by state:

Missouri Penalties

| Types of Penalties | 1st Offense | 2nd Offense | 3+ Offenses |

|---|---|---|---|

| Fine | Up to $500 | $200 - $500 | $200 - $500 |

| Driving Privileges | Suspension until insurance is obtained | 90-day suspension | 1-year suspension |

| Reinstatement Fee | $20 | $200 | $400 |

| Driving Record Points | 4 points | 4 points | 4 points |

| Confinement | N/A | Up to 15 days in jail | Up to 15 days in jail |

Kansas Penalties

| Types of Penalties | 1st Offense | 2nd Offense | 3+ Offenses |

|---|---|---|---|

| Fine | $300 - $1,000 | $800 - $2,500 | $1,500 - $2,500 |

| Driving Privileges | Suspension until insurance is obtained | Suspension until insurance is obtained | 3-year revocation |

| Reinstatement Requirements | $100 fee and SR-22 certificate | $100 fee (or $300 if within a year of prior offense) and SR-22 certificate | $100 fee (or $300 if within a year of prior offense) and SR-22 certificate |

| Confinement | Up to 180 days in jail | Up to 180 days in jail | Minimum 90 days in jail |

Illinois Penalties

| Types of Penalties | 1st Offense | Subsequent Offenses |

|---|---|---|

| Fine | $500 - $1,000; additional $1,000 if driving with suspended plates | $1,000; additional fines if involved in an accident |

| Driving Privileges | Suspension up to 90 days | Suspension for 120 days |

| Other | $100 reinstatement fee | $100 reinstatement fee and proof of financial responsibility |

What if You’re Uninsured and At Fault?

If you’re at fault and uninsured, the repercussions are more severe:

Financial Liability

- Damage Repair and Replacement Costs: You’re responsible for all property damage, including repairs or replacement of vehicles and other property.

- Medical Expenses: You’ll need to cover medical costs for any injuries sustained by other drivers, passengers, or pedestrians.

- Legal Fees: The other parties may sue you for damages, adding legal costs to your financial burden.

Higher Insurance Premiums

- Increased Future Costs: If you decide to purchase insurance after the accident, expect significantly higher premiums. Insurance companies view uninsured drivers involved in accidents as high-risk.

Why Auto Insurance Is Essential

Having auto insurance provides crucial protection that can save you from overwhelming financial strain:

- Property Coverage: Pays for repairs or replacement of your vehicle.

- Liability Coverage: Covers damages and injuries you may cause to others in an accident.

- Medical Coverage: Helps pay for medical expenses, rehabilitation, and sometimes lost wages or funeral costs.

- Average Cost of Insurance: The annual premium for full coverage averages around $2,458. This investment can protect you from paying tens of thousands of dollars out of pocket after an accident.

Additional Legal Considerations

- “No Pay, No Play” Laws: States like Missouri penalize uninsured drivers by limiting their ability to recover certain types of damages. This is commonly known as the “No Pay, No Play” Law in states that have adopted it.

- Non-Economic Damages: Uninsured drivers may forfeit the right to claim compensation for pain and suffering, emotional distress, and loss of enjoyment of life.

- Economic Damages Still Accessible: You can still seek compensation for direct financial losses like medical bills, lost wages, and property damage.

Benefits of Having an Attorney After a Car Accident

Navigating the aftermath of a car accident without insurance is complex. An experienced personal injury attorney can:

- Assess Liability: Determine who is at fault and the extent of negligence involved.

- Advocate on Your Behalf: Communicate with the at-fault driver’s insurance company to seek fair compensation.

- Collect Evidence: Gather essential documents like police reports, medical records, and property damage assessments.

- Evaluate Damages: Accurately calculate your economic and potential non-economic losses.

- Provide Legal Guidance: Help you understand your rights and the best course of action.

- Represent You in Legal Proceedings: Advocate for you in court if a lawsuit becomes necessary.

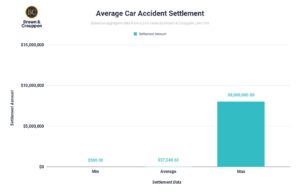

The car accident settlement process can present many challenges throughout the life of a claim, and an attorney can help at every step. It’s important to understand when to hire an attorney, and how they can help you maximize compensation after an auto accident.

Get a Free Case Evaluation from Brown & Crouppen

At Brown & Crouppen Law Firm, we understand the stress and uncertainty that follow a car accident – especially if you’re uninsured. Our experienced car accident lawyers are here to help you navigate this challenging time. We work on a contingency fee basis, meaning you pay nothing unless we win your case. With over $1 billion won in personal injury cases, we’re committed to achieving justice for our clients. We’ll help determine fault, build a strong claim, and fight for the compensation you deserve.

Getting started with your case is easy. Just call us at 888-802-8156 for a free consultation or get help with your case online from our legal team.