In most cases, a personal injury lawyer is not to blame for the slowed progress as there are many other parties and exchanges of information in personal injury claims. On average, car accident settlements take 6-9 months to settle. However, there are factors that can unexpectedly extend the length of the settlement.

Injured clients are anxious to get their life back together and be done with their injury case. They know that they are entitled to some kind of financial compensation, but they have no idea what to ask for (beyond the cost of medical bills and lost wages) and need a practiced hand to help guide them. They want the case to be over and done and insurance adjusters know that. They know that injured parties will often accept less than the true value of their personal injury claim just to be done with it.

Insurance adjusters will often “promise” to take care of all the medical bills (even before treatment is complete) and throw in a few extra bucks. What they don’t tell the claimant is that they won’t cover future medical treatment and may not cover all of the full medical bills or pay the health insurance subrogation (the amount that may need to be paid back to health insurance), leaving the remaining bills up to the injured party.

Use our legal checklist to learn what to do after an accident and understand key legal considerations for recovering financial compensation.

1. Length of Medical Treatment

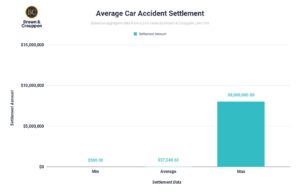

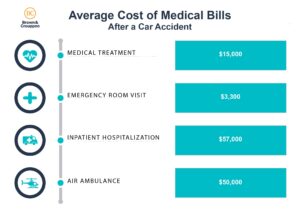

To get the full value out of your personal injury case, you need to reach maximum medical improvement, or something close to that, before settling your case. Until that point, the full extent of your damages are unknown. On average, medical expenses after a car accident are approximately $57,000. Maximum medical improvement doesn’t mean that you are back to the health that you had prior to the wreck, but rather that you are as good as you are going to get health-wise from a reasonable medical standpoint. This may be after a surgery plus weeks or months of physical therapy or multiple consultations. You have moved from active treatment for your injuries to no treatment or only conservative treatment (i.e. follow-ups with your doctors every six months to a year, depending on what your doctor recommends).

Reaching maximum medical improvement gives the injured party and the insurance adjuster a full picture of what your limitations are expected to be in at least the near future and possibly the years to come. It isn’t just the injury that determines the value of a claim, but the symptoms and limitations that result from the injury (such as those that result in pain and suffering after an auto accident).

2. Collecting Medical Bills & Records And Other Evidence

Once treatment is completed, then you’ll need to collect all of the medical bills and records to establish the cost of treatment and provide evidence of symptoms and limitations. As the injured party making a claim, you have the burden of proof not only that the other party is at fault for your injuries, but also that you suffered the actual injuries, that the incident caused the injuries, and that you experience symptoms and limitations as a result of your injuries.

The insurance company will not take you at your word. They want to pay as little as possible on your claim. You can prove your injuries and limitations by providing medical bills and records as well as information from your employer for being reimbursed for lost wages (or tax returns if you are self-employed). You may also provide contact information for witnesses to the incident in question or “damages” witnesses who can speak to how you functioned before the incident versus after with your related injuries. Additionally, filing a police report after a car accident can also help support your claim. However, the medical bills and records are generally the best evidence of your injuries.

While many people believe that obtaining medical bills and records is as simple as making a phone call or clicking a few buttons on their web browser, in fact, it’s a more costly and time-consuming venture. Most medical facilities have a dedicated records/billing department and requests go into a long queue of requests for records. Records requests must be accommodated by an authorization signed by the injured patient (or their guardian) allowing for the release of information. The authorization may limit what kind of material can be released and must be specified to a time period and to what provider’s information can be released. Some records departments have requests that are backlogged for a month or more. Additionally, the records/billing departments have a right to get paid for their time producing the information and once the request has been processed, they may require pre-payment before releasing the records.

3. Negotiations & Litigation

Once you have all the information to make your initial demand and get the demand sent off, you must give the insurance company a reasonable period of time to review the records and bills and make a liability determination (if one has not already been made) and to determine how much they are willing to offer on the claim. This period of time depends on the complexity of the case facts as well as the complexity of the injuries. A rear-end collision with soft tissue damages may only require a month to review the demand package whereas a wreck involving multiple drivers with catastrophic injuries may require 90+ days to decide. Additionally, the insurance company may request additional information to make their decision, such as prior medical records. However, not all requests for additional information by the insurance company are reasonable and may be a delay tactic. It’s up to your car accident lawyer to weigh whether to provide this additional information if they believe it will move the case along.

Usually, personal injury cases can be resolved through negotiations, but occasionally the personal injury attorney will recommend filing a lawsuit. Litigation is a time-consuming and tiring process, but often necessary to obtain a just result. Though most cases settle, even in litigation, many do so in the days and weeks immediately before their trial date, which could be years out from the date of filing the suit.

4. Paying Outstanding Bills

After you’ve finished treatment, gone through negotiations or potentially litigation, you have finally come to an agreement with the insurance company and agreed to a settlement amount. Your personal injury lawyer has told you what you can expect to receive out of the settlement after the attorney fees, case expenses, medical bills, and potentially health insurance or loan amounts are paid back. Still, it feels like it’s taking too long to get your check. Why?

Many medical or other insurance providers have a legal right to repayment. Some medical providers may have filed a lien on your case, meaning, they have deferred payment in exchange for the guarantee that they will be paid out of the settlement. Additionally, health insurance providers, including Medicare, Medicaid, Tricare, and other government-sponsored health insurance have a right to repayment on healthcare costs associated with your injury treatment (employer-sponsored health insurance providers may have a right to repayment; talk to your attorney to determine whether yours has a right to be paid back). Your attorney will likely be negotiating with these parties to obtain final payoff amounts before money can be disbursed..

Additionally, if you received policy limits offered in your case, your attorney will likely be investigating whether the at-fault defendant has any additional insurance coverage by requesting their insurance declaration page and, in some circumstances, an affidavit of no other insurance.

Were you injured in an accident due to someone else’s negligence? Get legal help from the most effective injury law firm in the Midwest.

Get Help With Your Car Accident Case From Brown & Crouppen Law Firm

If you or a loved one has been injured in a car accident and need guidance on when to settle and for how much, get help from the personal injury attorneys at Brown & Crouppen Law Firm by requesting a free case evaluation.

For general questions about an existing claim, contact our St. Louis car accident lawyers for updates or help with your case.