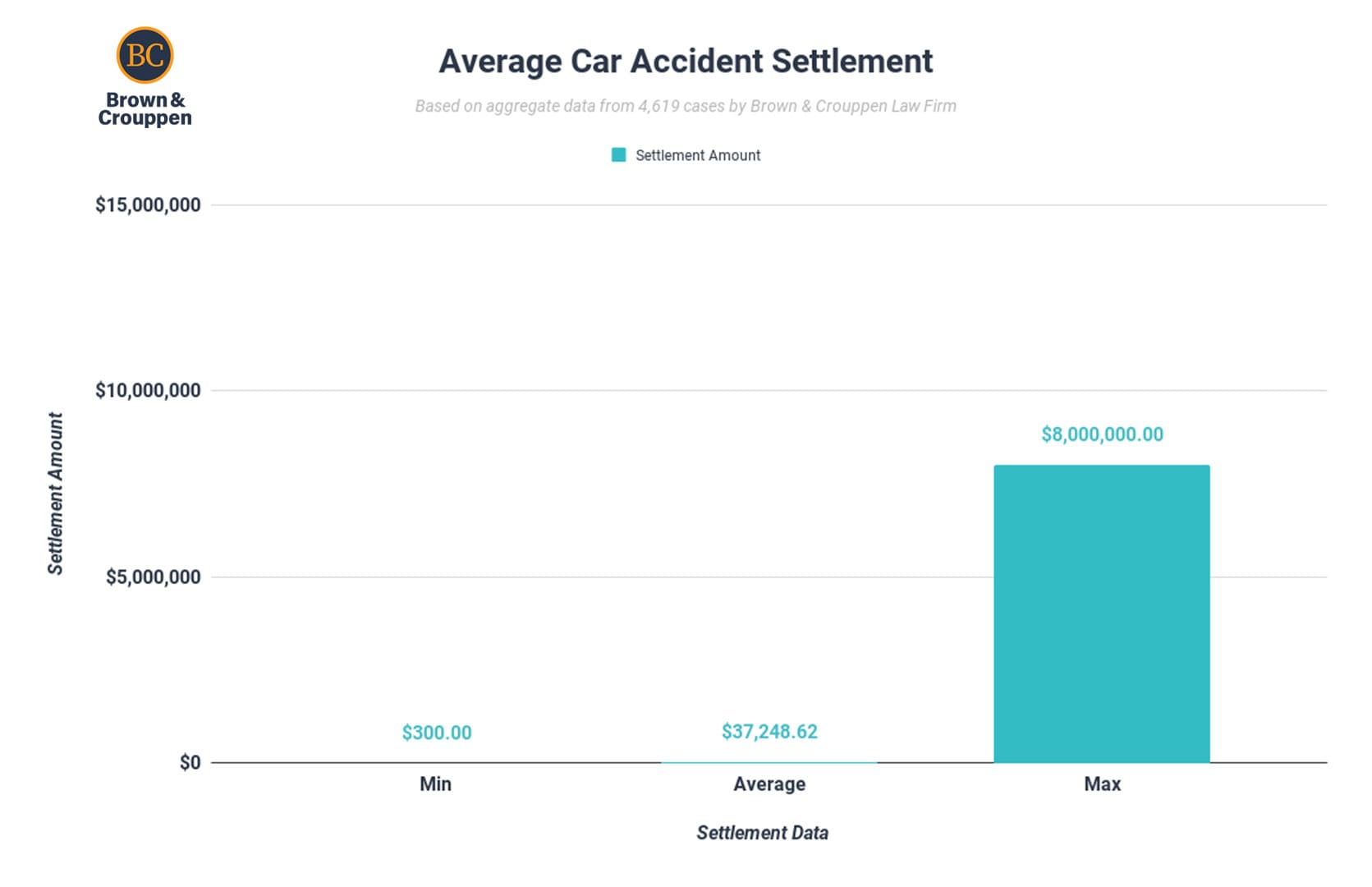

Additional auto accident settlement values are as follows:

- Average rear-end accident settlement: $10,000+

- Average drunk driver accident settlement: $10,000+

- Average uber accident accident settlement: $10,000+

- Average truck accident settlement: $103,654.08

- Average motorcycle accident settlement: $66,107.65

- Average pedestrian accident settlement: $67,511.90

- Average bicycle accident settlement: $10,000+

- Average passenger accident settlement: $5,000+

Average settlement data is not intended to be interpreted as a standard settlement or guaranteed payout for your case. Every case is unique, and final settlement amounts depend on many factors, although the severity of injuries is often the biggest one in determining a case’s value. To determine if you are eligible to recover compensation, request a free case evaluation from our legal team.

Use our legal checklist to learn what to do after an accident and understand key legal considerations for recovering financial compensation.

Factors That Affect The Amount Of Car Accident Settlements

There are many case factors that affect how car accident settlements are calculated, and their impact on the final settlement amount will often vary based on the unique circumstances and evidence surrounding the case.

1. Insurance Coverage

Most states have an insurance coverage requirement, which is usually $25,000 / person and $50,000 / accident. This is the minimum liability coverage requirement in Kansas, Illinois, and Missouri. Most states also require uninsured motorist coverage if an auto accident occurs with a driver who is uninsured. In Kansas, Illinois, and Missouri, the minimum requirement for uninsured motorist coverage is also $25,000 / person and $50,000 / accident.

Drivers’ insurance policies and insurance providers have a major influence on the car accident settlement process and the final amount of a car accident settlement.

2. Liability

If an accident happens in Missouri, the insurance company of the at-fault driver is responsible for paying medical bills, property damage, and any injuries that result from the car accident.

In some cases, it’s easy to prove who’s at-fault, while other cases may result in partial liability, a feature of comparative negligence that allows claimants to pursue compensation from defendants in accordance with defendants’ role in the accident. When a car accident fails to suggest a clear at-fault party, a claim may proceed to court or trial.

3. Severity of Injuries

The payout of car accident settlements are also highly influenced by the type of injuries an accident has caused. A car accident case involving a serious injury (such as a back and neck injury) is more likely to have a higher payout in comparison to a case involving only minor to moderate injuries like whiplash or lacerations.

A car accident injury such as those that are serious, life-changing, and non-recoverable justifies a higher payout than the typical car accident settlement where only minor injuries occurred. This is due to claims of pain and suffering in addition to greater medical expenses.

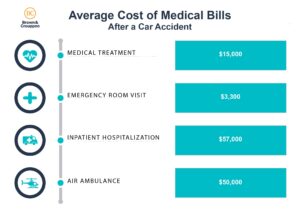

In fact, the average amount of medical expenses following a car accident can be as high as $57,000 if hospitalization is required. If you have been injured in an accident, there are many reasons to hire a lawyer after the car accident including helping you to understand how much your clam may be worth.

4. State Laws

Each state has unique laws regarding minimum insurance coverage, traffic laws, and governing laws that address how fault affects a car accident claim. A personal injury lawyer can shed light on how state laws affect a claim and determine what steps are best to take with regard to either a settlement or a car accident lawsuit. For example, each state has a car accident statute of limitations that determines the amount of time an individual has to pursue legal action after an accident.

5. Financial Loss

Financial loss is calculated when determining the payout of a car accident settlement and is another major factor in any car accident case. This includes vehicle damage, medical expenses, pain and suffering, and any lost wages that might occur due to being unable to work.

How Car Accident Settlements Are Calculated

How much someone receives from a settlement or how much someone can sue after a car accident largely depends on the insurance company and available coverage. As the most common sources of payout cases, a standard formula is used to calculate car accident settlements, which includes the following:

- Injury severity

- Pain and suffering

- PTSD

- Medical expenses (current and future)

- Lost wages

- Fault & Negligence

Available insurance coverage greatly depends on the wrongdoer and his or her insurance policy. If your injury is caused by an uninsured individual, that individual may not have the resources to pay a judgment against him or her. If your injury is caused by an insured individual, the amount you can recover in settlement may be limited by that individual’s insurance policy. The limit of each individual’s insurance policy depends on how much insurance that individual can afford. For example, businesses or large corporations likely have more coverage and higher limits on their insurance policies than average individuals do. Furthermore, most states only require a minimum of $25,000 in personal automobile liability coverage per person for any single crash and $50,000 combined total coverage for any single crash. Unfortunately, that means you may not even be able to recover $25,000 if three or more people are injured in the car accident.

Note: For more information about maximizing your settlement, see our guide on how to get more money from a car accident settlement.

Car Accident Settlement Examples

Brown & Crouppen is proud to have secured significant car accident settlement amounts for our clients. Our recent notable settlements include the following:

- $500K settlement for a client injured in a high-speed rear-end collision in Lees Summit

- $450K settlement for a woman injured by a drunk driver in Jefferson County

- $100K settlement for a client who needed back surgery after a St. Louis car collision

- $100K settlement for a client injured in a rear-end collision in St. Louis

Depending on the circumstances of your car accident, you may be eligible for compensation. A skilled and knowledgeable car accident attorney can pursue the compensation you deserve and seek the maximum settlement possible.

Get Help With Your Car Accident Settlement From Brown & Crouppen Law Firm

A car accident lawyer in St. Louis or Kansas City can help you maximize the compensation of your car accident settlement by collecting evidence, handling the legal process, and negotiating with the insurance company. If you’ve been injured in a car accident, immediately seek medical attention and free consultation.

Due to the statute of limitations, it’s important to get started on your claim as soon as possible. Request a free case evaluation from a personal injury attorney at Brown & Crouppen, or call 888-801-4736 to get started.